Answers

Answer:

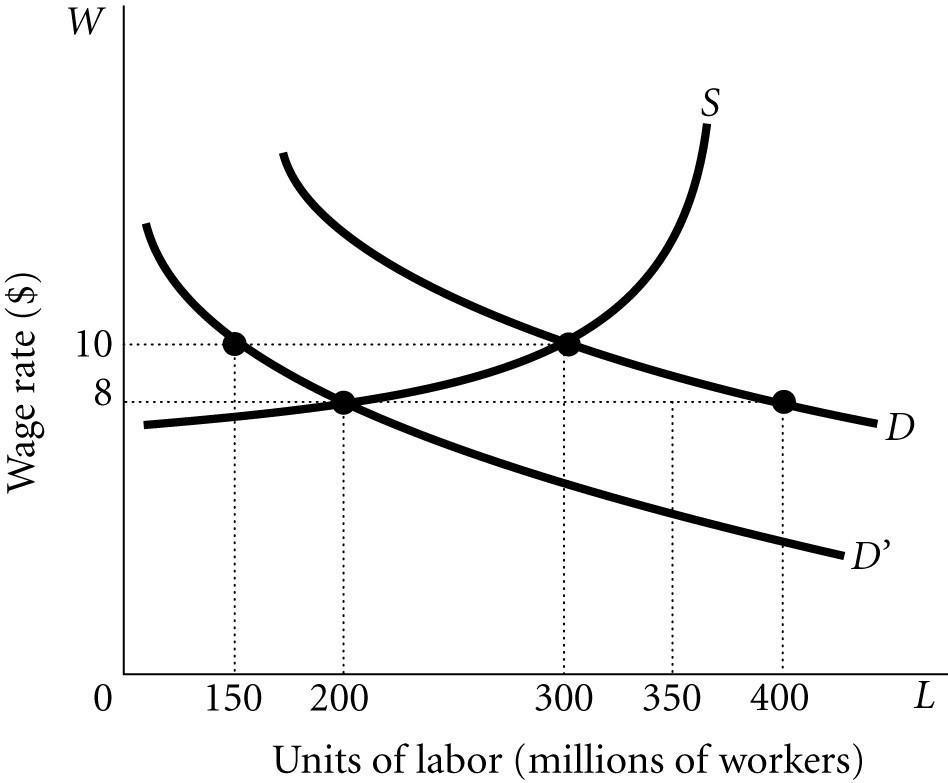

There will be unemployment of 100 million. The correct option is b. 100.

Explanation:

Note: This question is not complete because the graph is not attached. The graph is therefore provided before answering the question. See the attached photo for the graph.

From the attached graph, we have:

Equilibrium units of labor at D = 300 million

Equilibrium units of labor at D’ = 200 million

Employment If the demand for labor falls from D to D' = Equilibrium units of labor at D’ - Equilibrium units of labor at D = 300 million - 200 million = 100 million

Therefore, there will be unemployment of 100 million. The correct option is b. 100.

Related Questions

A factory worker makes $17.50 per hour. Next month, she will receive a 1.5% increase in her hourly rate. What will her new hourly rate be?

Answers

Answer:

$19.00

Explanation:

1.5% of 17.5 is .26

Add .26 to 17.50.

Coordination refers to ________. a. identifying the span of control within an organization b. portioning the performance of specific tasks c. assigning tasks to qualified managers d. linking various value activities within an organization

Answers

Answer:

d. linking various value activities within an organization.

Explanation:

A functional (departmental) organizational structure is a type of structure used to organize staffs by dividing them into various departments based on their skill set, roles or functions and knowledge.

These departments which are vertically structured may include, finance, IT, sales and marketing, research and development, customer service etc. Also, the various departments are headed by a functional manager who are saddled with the responsibility of overseeing, managing and reporting to the executive management.

The employees in companies engaged in a single line of business are generally referred to as silos because they work independently, collaborate and communicate with their colleagues in a vertical style i.e exclusively with each other.

A manager can be defined as an individual who is saddled with the responsibility of providing guidance, support, supervision, administrative control, as well as acting as a role model or example to the employees working in an organization by being morally upright.

Generally, managers are typically involved in taking up leadership roles and as such are expected to be build a strong relationship between their employees or subordinates by creating a fair ground for effective communication and sharing of resources and information. Also, they are required to engage their staff members (entire workforce) in the most efficient and effective manner.

Coordination refers to linking various value activities within an organization.

Answer:

d. linking various value activities within an organization.

Explanation:

Coordination refers to linking various value activities within an organization.

Consider the following $1000 par value zero-coupon Treasury bonds: Bond Years to Maturity Yield to Maturity A 1 4.00% B 2 4.50% C 3 5.11% D 4 5.86% E 5 6.25% The expected 2-year interest rate three years from now should be __________. Enter your answer in percent to the nearest hundredth, for example if your answer is .25432, enter 25.43.

Answers

Answer: 7.98%

Explanation:

This deals with spot rates and forward rates. The 2 year interest rate three years from now is the 2 year forward rate, 3 years from now.

It can be calculated through the relationship below:

(1 + 5 year spot rate)⁵ = (1 + third year spot rate)³ * (1 + 2 year forward rate)²

(1 + 6.25%)⁵ = (1 + 5.11%)³ * (1 + 2 year forward rate)²

1.35408 = 1.161267 * (1 + 2 year forward rate)²

(1 + 2 year forward rate)² = 1.35408 / 1.161267

1 + 2 year forward rate = √1.16603675

2 year forward rate = √1.16603675 - 1

= 7.98%

What is the purpose of a W-2 form and how is it used to file taxes?

Answers

Question 13 Pina Colada Corp. has the following inventory data: July 1 Beginning inventory 108 units at $19 $2052 7 Purchases 378 units at $20 7560 22 Purchases 54 units at $22 1188 $10800 A physical count of merchandise inventory on July 30 reveals that there are 180 units on hand. Using the FIFO inventory method, the amount allocated to ending inventory for July is $3960. $3492. $3600. $3708.

Answers

Answer:

Endign inventory cost= $3,708

Explanation:

Giving the following information:

Purchases 378 units at $20

Purchases 54 units at $22

Under the FIFO (first-in, first-out) method, the ending inventory is calculated using the cost of the lasts units incorporated into inventory:

Ending inventory in units= 180

Endign inventory cost= 54*22 + 126*20

Endign inventory cost= $3,708

A company's flexible budget for 22,000 units of production showed per unit contribution margin of $3.50 and fixed costs, $38,600. The operating income expected if the company produces and sells 28,000 units is:

Answers

Answer:

$59,400

Explanation:

Operating income = Contribution - Fixed Costs

therefore,

At the activity of 28,000 units results will be :

Contribution (28,000 units x $3.50) $98,000

Less Fixed Costs ($38,600)

Operating Income $59,400

Thus,

The operating income expected if the company produces and sells 28,000 units is $59,400

Carmel Corporation is considering the purchase of a machine costing $52,000 with a 4-year useful life and no salvage value. Carmel uses straight-line depreciation and assumes that the annual cash inflow from the machine will be received uniformly throughout each year. In calculating the accounting rate of return, what is Carmel's average inv

Answers

Answer:

$26,000

Explanation:

Average investment = (Initial investment + Salvage value) / 2

Average investment = ($52,000 + $0) / 2

Average investment = $52,000 / 2

Average investment = $26,000

So, Carmel's average investment is $26,000.

Identify the statement below that is true regarding the Allowance for Doubtful Accounts account. Multiple Choice The account has a normal credit balance and is reported on the balance sheet. The account has a normal debit balance and is reported on the balance sheet. The account has a normal credit balance and is reported on the income statement. The account has a normal debit balance and is reported on the income statement.

Answers

Answer: The account has a normal credit balance and is reported on the balance sheet.

Explanation:

The allowance for doubtful accounts refers to the amount of account receivable that the company believes will not be paid by the customers. It is referred to as the bad debt reserve as well.

The allowance for doubtful accounts reduces the accounts receivable. It also has a normal credit balance and is reported on the balance sheet.

A business owned and run by one person is called a(n)

Answers

a business owned and run by one person is called a(n)

sole proprietorship

What is the present value of 4360 to be received at the beginning of each of 30 periods discounted at 5% compound interest

Answers

Answer:

The right solution is "70375.08".

Explanation:

Given that,

Present value,

= 4360

Interest rate,

= 5%

Time period,

= 30

Now,

The present value of inflows will be:

= [tex](1+rate)\times \frac{Present \ value[1-(1+Interest \ rate)^{-time \ period}]}{rate}[/tex]

= [tex]1.05\times 4360\times \frac{[1-(1.05)^{-30}]}{0.05}[/tex]

= [tex]4360\times 16.1410736[/tex]

= [tex]70375.08[/tex]

A company's Cash account shows an ending balance of $4,600. Reconciling items included a bookkeeper error of $105 (a $525 check recorded as $630), two outstanding checks totaling $830, a service charge of $20, a deposit in transit of $260, and interest revenue of $33. What is the adjusted book balance

Answers

Answer:

$5,275

Explanation:

Bank Reconciliation Statement

Balance as per Cash Book $4,600

Add check error $105

Add unpresented checks $830

Less Lodgments not yet credited ($260)

Balance as per Bank Statement $5,275

therefore,

The adjusted Cash book balance is $5,275

A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 36%, while stock B has a standard deviation of return of 16%. The correlation coefficient between the returns on A and B is 0.30. Stock A comprises 30% of the portfolio, while stock B comprises the rest of the portfolio. What is the standard deviation of the return on this portfolio?

Answers

Answer: 17.7%

Explanation:

Standard deviation of portfolio = √(Weight of A² * Standard deviation of A² + Weight of B² * Standard deviation of B² + 2 * Weight of A * Weight of B * Correlation coefficient of A and B * Standard deviation of A * Standard deviation of B)

= √(30%² * 36%² + 70%² * 16%² + 2 * 30% * 70% * 0.30 * 36% * 16%)

= √0.0314656

= 17.7%

Beacon Company is considering automating its production facility. The initial investment in automation would be $15 million, and the equipment has a useful life of 10 years with a residual value of $500,000. The company will use straight-line depreciation. Beacon could expect a production increase of 40,000 units per year and a reduction of 20 percent in the labor cost per unit.

Determine the project's accounting rate of return. (Round your answer to 2 decimal places.)

Accounting Rate of Return____________

Determine the project's payback period. (Round your answer to 2 decimal places.)

Payback Period _______________years

Using a discount rate of 15 percent, calculate the net present value (NPV) of the proposed investment. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign.)

Net Present Value ______________

Recalculate the NPV using a 10% discount rate. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign.)

Net Present Value_________

Answers

Question Completion:

Current Proposed

no automation with automation

Production and Sales Volume 80,000 units 120,000 units

Per unit Per unit

Sales revenue $90 $7,200,000 $90 $10,800,000

Variable costs

Direct materials 18 18

Direct labor 25 20

Variable overhead 10 10

Total variable costs 53 48

Contribution per unit $37 2,960,000 $42 5,040,000

Fixed costs 1,250,000 2,350,000

Net operating income $1,710,000 $2,690,000

Answer:

Beacon Company

a. The project's accounting rate of return = Net operating income/Initial investment * 100

= $2,690,000/$15,000,000 * 100

= 17.93%

b. The project's payback period =

Initial investment/Net Annual Cash inflow

= $15,000,000/$4,140,000

= 3.62 years

c. NPV (PV factor at 15% for 10 years)

Cash flows Amount PV factor PV

Cash outflows = $15,000,000 1 -$15,000,000

Cash inflows = 4,140,000 5.019 20,778,660

Salvage value 500,000 0.247 123,500

NPV = $5,902,160

c. NPV (PV factor at 10% for 10 years)

Cash flows Amount PV factor PV

Cash outflows = $15,000,000 1 -$15,000,000

Cash inflows = 4,140,000 6.145 25,440,300

Salvage value 500,000 0.386 193,000

NPV = $10,633,300

Explanation:

a) Data and Calculations:

Initial investment cost of production facility = $15 million

Estimated useful life of equipment = 10 years

Residual value = $500,000

Annual depreciation expense = $1,450,000 ($15m - $500,000)/10

Net Annual Cash inflows = Net operating income + Depreciation

= $2,690,000 + $1,450,000 = $4,140,000

define biospheredefine biosphere

Answers

Answer:

Explanation:

The biosphere (from Greek βίος bíos "life" and σφαῖρα sphaira "sphere"), also known as the ecosphere (from Greek οἶκος oîkos "environment" and σφαῖρα), is the worldwide sum of all ecosystems. It can also be termed the zone of life on Earth. The biosphere is virtually a closed system with regards to matter, with minimal inputs and outputs. With regards to energy, it is an open system, with photosynthesis capturing solar energy at a rate of around 130 Terawatts per year. However it is a self-regulating system close to energetic equilibrium. By the most general biophysiological definition, the biosphere is the global ecological system integrating all living beings and their relationships, including their interaction with the elements of the lithosphere, cryosphere, hydrosphere, and atmosphere. The biosphere is postulated to have evolved, beginning with a process of biopoiesis (life created naturally from non-living matter, such as simple organic compounds) or biogenesis (life created from living matter), at least some 3.5 billion years ago.

Answer:

the regions of the surface, atmosphere, and hydrosphere of the earth (or analogous parts of other planets) occupied by living organisms.

Required information Exercise 10-11 Effects of Changes in Profits and Assets on Return on Investment (ROI) [LO10-1] Skip to question [The following information applies to the questions displayed below.]

Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reported the following results for the past year:

Sales $ 780,000

Net operating income $ 17,940

Average operating assets $ 100,000

The following questions are to be considered independently.

Assume that the manager of the club is able to reduce expenses by $3,120 without any change in sales or average operating assets.

What would be the club’s return on investment (ROI)? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Answers

Answer:

Fitness Fanatics

Springfield Club

The return on investment (ROI) = = 21.06%

Explanation:

a) Data and Calculations:

Sales $ 780,000

Net operating income $ 17,940

Average operating assets $ 100,000

1. Assume that the manager of the club is able to reduce expenses by $3,120 without any change in sales or average operating assets, the return on investment would be:

= Net operating income/Average operating assets * 100

= ($ 17,940 + $3,120)/$ 100,000 * 100

= 21.06%

b) The return on investment metric measures an entity's financial performance, using the annual returns and average operating assets or initial investment cost.

The Walking Dead Co. provides services on-account and in exchange for cash. All general ledger accounts are adjusted monthly. For September, the following information is available: Accounts Receivable on September 1st is $22,400 (debit) Allowance for Doubtful Accounts on September 1st is $4,400 (credit) Services provided during September for cash $20,000 Services provided during September on-account $45,000 During the month collections on account were $34,400 and accounts written off as uncollectible were $2,000. The Walking Dead estimates bad debts at 8% of accounts receivable. After adjusting journal entries are recorded, what is the September 30th balance in Allowance for Doubtful Accounts

Answers

Answer:

See below

Explanation:

Given that,

Accounts receivables :

Beginning balance 1 September = $22,400

Services on account = $45,000

Cash collected = $34,400

Written off accounts = $2,000

Allowance for doubtful accounts:

Beginning balance 1 September = $4,400

Adjusted balance for Allowance for doubtful accounts on 30th September

= Beginning balance 1 September - Written off accounts + Bad debt expense

= $4,400 + $2,000 + ($45,000 × 8%)

= $4,400 + $2,000 + $3,600

= $6,000

On December 1, a six-month liability insurance policy was purchased for $1,134. Analyze the required adjustment as of December 31 using T accounts, and then formally enter this adjustment in the general journal. (Trial balance is abbreviated as TB.)

Answers

Answer and Explanation:

As the insurance policy would be for 6 months

So per month it is

= $1,134 ÷ 6 months

= $189

Now the T account is

Prepaid insurance

Opening balance $1,134 Insurance expense $189

balance $945

Income statement

Adjustment $189

Journal entry

Insurance expense $189

To Prepaid insurance $189

(Being insurance expense is recorded)

DS Unlimited has the following transactions during August.

August 6 Purchases 54 handheld game devices on account from GameGirl, Inc., for $120 each, terms 1/10, n/60.

August 7 Pays $320 to Sure Shipping for freight charges associated with the August 6 purchase.

August 10 Returns to GamerGirl four game devices that were defective.

August 14 Pays the full amount due to GameGirl.

August 23 Sells 34 game devices purchased on August 6 for $140 each to customers on account. The total cost of the 34 game devices sold is $4,257.00. 2.

Required:

Record the period-end adjustment to cost of goods sold on August 31, assuming the company has no beginning inventory and ending inventory has a cost of $2,003.

Answers

Answer:

August 6

Debit: Inventory: (54 * $120) = $6480.00

Credit: Accounts Payable: $6,480.00

August 7 - shipping

Debit: Inventory $320.00

Credit: Cash $320.00

August 10

Debit: Accounts Payable :(4 * $120) = $480.00

Credit: Inventory $480.00

August 14

Debit: Accounts Payable : $(6480 - 480) = $6000.00

Credit: Inventory $60.00

Cash : $(6000 - 60) = $5940.00

(August 14th Inventory: $6000 × 1% = $60)

August 23

Debit: Accounts Receivable ($140*34) = $4760

Credit: sales Revenue $4760

August 23

Debit: Cost of Goods Sold $4,257.00

Credit: Inventory $4,257.00

Explanation:

INVENTORY:

Selected information from Jacklyn Hyde Corporation's accounting records and financial statements for 2021 is as follows ($ in millions): Cash paid to retire notes $ 94 Common shares acquired for treasury 154 Proceeds from issuance of preferred stock 218 Proceeds from issuance of subordinated bonds 274 Cash dividends paid on preferred stock 77 Cash interest paid to bondholders 107 In its statement of cash flows, Jacklyn Hyde should report net cash inflows from financing activities of: Multiple Choice $325 million. $167 million. $218 million. $64 million.

Answers

Answer:

$167 million

Explanation:

Particulars Amount ($ millions)

Cash paid to retire note -94

Less: Common shares acquired for treasury -154

Add: Proceeds from issue of preferred stock 218

Add: Proceeds from issue of subordinated bonds 274

Less: Cash dividends paid on preferred stock -77

Net cash from financing activities 167

Note: Cash interest paid to bondholders belongs to Operating activity

The following transactions occurred during July: Received $1,600 cash for services performed during July. Received $7,800 cash from the issuance of common stock to owners. Received $800 from a customer as payment for services performed during June. Billed $4,700 to customers for services performed on account in July. Borrowed $3,300 from the bank and signed a promissory note. Received $2,200 from a customer for services to be performed during August. What is the amount of revenue that will be reported on the income statement for the month ended July 31

Answers

Answer:

the amount of revenue that should be reported is $6,300

Explanation:

The computation of the amount of revenue that should be reported is shown below;

= Cash received + service revenue earned on the account

= $1,600 + $4,700

= $6,300

hence, the amount of revenue that should be reported is $6,300

Basically we add the two items so that the correct value could arrive

Which options are available when exporting a table definition and data? Check all that apply

Answers

Answer: 1. appending data to an existing table

4. creating a new table and inserting data

Explanation:

An organization wants to provide its employees information about what its goals are and what it expects employees to accomplish. It is planning to implement an incentive plan that helps employees understand the organization's goals. Which plan should be used by this organization?

Answers

Answer:

This question is incomplete, the options are missing. The options are the following:

a) A retention bonus

b) A piecework rate system

c) A merit pay system

d) The Scanlon plan

e) A balanced scorecard

And the correct answer is the option E: A balanced scorecard.

Explanation:

To begin with, the term known as "Balanced Scorecard" it is a very famous strategy method used in the fields of management and business in order to achieve higher levels of administration from the managers and owners. It is a technique that involves the company's short and long term goals and the way to plan how to incentive the employees of the company in order for them to grow and understand better the plans of the organization so that they could work better and increase the productivity that will consequently affect in the benefits of the enterprise as a whole.

what are the Computer Design problems and their solutions?

Answers

ABM, Kaizen Costing Baker, Inc., supplies wheels for a large bicycle manufacturing company. The bicycle company has recently requested that Baker decrease its delivery time. Baker made a commitment to reduce the lead time for delivery from seven days to one day. To help achieve this goal, engineering and production workers had made the commitment to reduce time for the setup activity (other activities such as moving materials and rework were also being examined simultaneously). Current setup times were 12 hours. Setup cost was $600 per setup hour. For the first quarter, engineering developed a new process design that it believed would reduce the setup time from 12 hours to nine hours. After implementing the design, the actual setup time dropped from 12 hours to seven hours. Engineering believed the actual reduction was sustainable. In the second quarter, production workers suggested a new setup procedure. Engineering gave the suggestion a positive evaluation, and they projected that the new approach would save an additional six hours of setup time. Setup labor was trained to perform the new setup procedures. The actual reduction in setup time based on the suggested changes was four hours.

Required:

1. What kaizen setup standard would be used at the beginning of each quarter?

2. How much non-value-added cost was eliminated by the end of two quarters?

Answers

Answer and Explanation:

the computation is shown below:

1. Setup Time standard

Here the first quarter standard would be considered i.e. 9 hours so we dont take the actual setup time

The Second quarter is 1 hour that denotes the Expected setup time

2. The Total non-value cost which got eliminated is

Since, The setup time was Decrease from 12 hours to 3 hours.

So, the Total non value added cost eliminated is

= $600 × (12 - 3)

= $600 × 9

= $5,400

An unfinished desk is produced for $35.65 and sold for $64.20. A finished desk can be sold for $76.00. The additional processing cost to complete the finished desk is $6.15. Provide a differential analysis for further processing. Round your answers to two decimal places, if necessary. Differential revenue from further processing:

Revenue per unfinished desk $___________

Revenue per finished desk _______________

Differential revenue $____________

Differential cost per desk:

Additional cost for producing ___________

Differential from further processing __________

Answers

Answer:

Differential revenue from further processing:

= $11.80.

Explanation:

a) Data and Calculations:

Cost of production of an unfinished desk = $35.65

Selling price of an unfinished desk = $64.20

Selling price of a finished desk = $76.00

Additional processing cost = $6.15

Revenue per finished desk $76.00

Revenue per unfinished desk 64.20

Differential revenue $11.80

Differential cost per desk:

Cost of unfinished desk $35.65

Additional cost for producing 6.15

Differential from further processing $41.80

Unfinished Finished Differential

Revenue $64.20 $76.00 $11.80

Cost of production (35.65) (41.80) (6.15)

Net income $28.55 $34.20 $5.65

Saginaw Steel Corporation has a precredit U.S. tax of $105,000 on $500,000 of taxable income in 2018. Saginaw has $200,000 of foreign source taxable income and paid $60,000 of income taxes to the German government on this income. All of the foreign source income is treated as foreign branch income for foreign tax credit purposes. Saginaw's foreign tax credit on its 2018 tax return will be:

Answers

Answer: $42000

Explanation:

Saginaw's foreign tax credit on its 2018 tax return will be calculated thus:

= Foreign source taxable income × precredit U.S tax/Taxable income

= 200000 × 105000/500000

= 200000 × 0.21

= 42000

Therefore, the foreign tax credit will be the least between $60,000 paid to the German government or $42000. In this case, the answer is $42000

Gallatin County Motors Inc. assembles and sells snowmobile engines. The company began operations on July 1 and operated at 100% of capacity during the first month. The following data summarize the results for July: 1 Sales (38,000 units) $9,500,000.00 2 Production costs (44,000 units): 3 Direct materials $4,400,000.00 4 Direct labor 1,760,000.00 5 Variable factory overhead 1,100,000.00 6 Fixed factory overhead 660,000.00 7,920,000.00 7 Selling and administrative expenses: 8 Variable selling and administrative expenses $1,170,000.00 9 Fixed selling and administrative expenses 200,000.00 1,370,000.00 Required: a. Prepare an income statement according to the absorption costing concept\.\* b. Prepare an income statement according to the variable costing concept\.\* c. What is the reason for the difference in the amount of Operating income reported in (a) and (b)

Answers

Answer:

a.

income statement according to the absorption costing concept.

Sales $9,500,000.00

Less Cost of Sales ($6,840,000.00)

Gross Profit $2,660,000.00

Less Expenses

Variable selling and administrative expenses ($1,170,000.00)

Fixed selling and administrative expenses ($200,000.00)

Net Income $1,290,000.00

b.

income statement according to the variable costing concept

Sales $9,500,000.00

Less Cost of Sales ($6,270,000.00)

Contribution $3,230,000.00

Less Expenses

Fixed factory overhead ($660,000.00)

Variable selling and administrative expenses ($1,170,000.00)

Fixed selling and administrative expenses ($200,000.00)

Net Income $1,200,000.00

c.

The difference is due to fixed cost included in closing inventory under the absorption costing concept.

Explanation:

Production Cost - Absorption Costing

Direct materials $4,400,000.00

Direct labor $1,760,000.00

Variable factory overhead $1,100,000.00

Fixed factory overhead $660,000.00

Total $7,920,000.00

therefore,

Cost of Sales = 38,000 units/ 44,000 units x $7,920,000.00

= $6,840,000

Production Cost - Variable Costing

Direct materials $4,400,000.00

Direct labor $1,760,000.00

Variable factory overhead $1,100,000.00

Total $7,260,000.00

therefore,

Cost of Sales = 38,000 units/ 44,000 units x $7,260,000.00

= $6,270,000

a. Income Statement according to Absorption Costing Concept:

Sales: $9,500,000.00

Cost of Goods Sold:

Direct Materials: $4,400,000.00

Direct Labor: $1,760,000.00

Variable Factory Overhead: $1,100,000.00

Fixed Factory Overhead: $660,000.00

Total Manufacturing Costs: $7,920,000.00

Gross Profit: $1,580,000.00

Selling and Administrative Expenses:

Variable Selling and Administrative Expenses: $1,170,000.00

Fixed Selling and Administrative Expenses: $200,000.00

Total Selling and Administrative Expenses: $1,370,000.00

Operating Income: $210,000.00

b. Income Statement according to Variable Costing Concept:

Sales: $9,500,000.00

Variable Costs:

Direct Materials: $4,400,000.00

Direct Labor: $1,760,000.00

Variable Factory Overhead: $1,100,000.00

Variable Selling and Administrative Expenses: $1,170,000.00

Total Variable Costs: $8,430,000.00

Contribution Margin: $1,070,000.00

Fixed Costs:

Fixed Factory Overhead: $660,000.00

Fixed Selling and Administrative Expenses: $200,000.00

Total Fixed Costs: $860,000.00

Operating Income: $210,000.00

In absorption costing, fixed manufacturing overhead is treated as a product cost and is included in the cost of goods sold. This means that a portion of fixed overhead is allocated to each unit produced, resulting in higher inventory values and a higher cost of goods sold.

In variable costing, fixed manufacturing overhead is treated as a period cost and is not included in the cost of goods sold. It is instead expensed in the period incurred. This means that fixed overhead is only expensed when it is incurred and is not allocated to units in inventory.

Since the number of units produced (44,000 units) exceeded the number of units sold (38,000 units), the fixed overhead allocated to the 6,000 unsold units under absorption costing contributes to the difference in reported operating income between the two methods. In this case, the absorption costing method reports higher operating income due to the allocation of fixed overhead to units in inventory.

Learn more about Absorption Costing here:

https://brainly.com/question/31116042

#SPJ6

Riverboat Adventures pays $170,000 plus $14,000 in closing costs to buy out a competitor. The real estate consists of land appraised at $22,000, a building appraised at $79,200, and paddleboats appraised at $118,800. Compute the cost that should be allocated to the building. Multiple Choice $66,240. $61,200. $79,200.

Answers

Answer:

Total cost allocated to building = $66,240

Explanation:

Given:

Total amount pay = $170,000 + $14,000 = $184,000

Land appraised amount = $22,000

Building appraised amount = $79,200

Paddleboats appraised price = $118,800

Find:

Total cost allocated to building

Computation:

Total appraisal price = Land appraised amount + Building appraised amount + Paddleboats appraised price

Total appraisal price = $22,000 + $79,200 + 118,800

Total appraisal price = $220,000

Total cost allocated to building = [Total amount pay / Total appraisal price]Building appraised amount

Total cost allocated to building = [184,000/220,000]79,200

Total cost allocated to building = $66,240

On January 15, 2020, Vern purchased the rights to a mineral interest for $3,500,000. At that time, it was estimated that the recoverable units would be 500,000. During the year, 40,000 units were mined and 25,000 units were sold for $800,000. Vern incurred expenses during 2020 of $500,000. The percentage depletion rate is 22%. Determine Vern's depletion deduction for 202

Answers

Answer: $175,000

Explanation:

Vern's depletion deduction for 2020 will be calculated thus:

= (Cost - Salvage value) / (Estimated Number of units × Number of units extracted

= 3500000/500000 × 25000

= 7 × 25000

= $175000

Therefore, Vern's depletion deduction for 2020 is $175000

The Fortise Corporation manufactures two types of vacuum cleaners, the Victor for commercial building use and the House-Mate for residences. Budgeted and actual operating data for the year 2017 were as follows: Static Budget Victor House-Mate Total Number sold 20,000 80,000 100,000 Contribution margin $4,600,000 $15,200,000 $19,800,000 Actual Results Victor House-Mate Total Number sold 21,500 64,500 86,000 Contribution margin $6,665,000 $14,190,000 $20,855,000 What is the total sales-mix variance closest to in terms of the contribution margin

Answers

Answer:

The Fortise Corporation

The total sales-mix variance closest to $1,055,000 in terms of the contribution margin.

Explanation:

a) Data and Calculations:

Static Budget Victor House-Mate Total

Total Number sold 20,000 80,000 100,000

Contribution margin $4,600,000 $15,200,000 $19,800,000

Actual Results Victor House-Mate Total

Number sold 21,500 64,500 86,000

Contribution margin $6,665,000 $14,190,000 $20,855,000

Variance

Number sold 1,500 F 15,500 U 14,000 U

Contribution margin $2,065,000 F $1,010,000 U $1,055,000 F